Spain’s factory sector cooled a little last month, but is still growing:

Michael Hewson 🇬🇧

(@mhewson_CMC)Spain Manufacturing PMI (Jul) falls back to 54, from 54.7

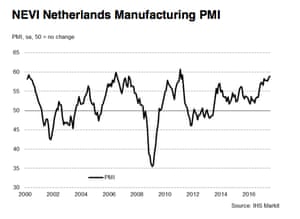

Dutch manufacturing hits six-year highs

Factories in the Netherlands helped drive the eurozone recovery in July.

The Dutch manufacturing PMI has climbed to 58.9 in July, up from June’s 58.6 and its highest reading since April 2011.

New orders, output and employment levels all surged, suggesting that the sector strengthened last month.

Dutch manufacturing PMI Photograph: Markit

Over in the City, shares in Rolls-Royce have surged over 5% after reporting better-than-expected earnings.

Underlying profits at the engineering firm jumped to £287m for the last six months, up from £104m a year ago.

Strong sales of Rolls’ Trent engines helped it recover from the huge bribery scandal that rocked the firm.

Centrica hikes prices

Millions of British Gas customers have woken up to the bad news that their energy bills are going up.

It’s a big rise too! Centrica is hiking its electricity prices by 12.5% but left gas prices unchanged. This means the average dual fuel bill will rise by 7.3% to £1,120.

More than three million customer will be hit — although Centrica will provide a £76 credit to more than 200,000 vulnerable customers to protect them from the increase.

Here’s the full story:

Centrica boss Iain Conn just faced the music on Sky News, arguing that the rise is driven by “underlying increases in costs”.

Sky’s Sarah-Jane Mee isn’t impressed, though, telling Conn that she’d hoped to read out some of the comments received over social media, but they’re not suitable for a family audience.

She adds:

“Greedy” is one of the words I can read out…..

Sky News

(@SkyNews)British Gas is putting up electricity prices by 12.5% in September. @skysarahjane asked the chief exec of British Gas owner Centrica why pic.twitter.com/7JnHnhbkfG

Updated

China factory growth accelerates as exports rise

Employees at a engine factory of CSSC Wartsila Engine (Shanghai) Co. Ltd in Shanghai, China. Photograph: Aly Song/Reuters

China got manufacturing PMI day off to a solid start, by posting its best figures in four months.

The Caixin China manufacturing PMI for July jumped to 51.1, up from 50.4 in June.

Any reading over 50 shows growth, and this also beats City expectations.

Mauro Ippolito 📈

(@MauroIppolito)China July Caixin Manufacturing PMI comes in at 51.1 (f’cast 50.4) vs 50.4 in June

Factory bosses reported that output and total new orders expanded at the fastest pace since February.

In another encouraging sign, new export sales rose at the second-fastest rate for nearly three years. That could bode well for global growth.

But…. Chinese manufacturers also shed jobs last month, at the fastest rate in 10 months. That meant that the backlog of unfinished work stacked up….

Dr Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, says the data is encouraging:

Operating conditions in the manufacturing sector improved further in July, suggesting the economy’s growth momentum will be sustained. That said, it’s unlikely that financial regulatory tightening will be relaxed.”

The agenda: Manufacturing reports and eurozone growth

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Is Europe’s recovery on firm foundations? We find out today, when the first estimate of eurozone GDP for the second quarter of 2017 is released.

Economists are expecting to see solid growth, with GDP perhaps expanding by 0.6% in April to June. If so, that would broadly match America’s performance, and be twice as fast as Britain.

We also discover how the world’s factories fared in July, as data firm Markit rolls out its monthly PMI surveys. They may show that eurozone manufacturing hit a six-year high last month, and that UK growth picked up too.

European stock markets are expected to open higher, with the FTSE 100 called up 0.5%.

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7409 +0.51%

$DAX 12125 +0.05%

$CAC 5097 +0.07%$IBEX 10511 +0.08%$MIB 21484 -0.01%

There’s also a blizzard of corporate news; engineering group Rolls-Royce, oil giant BP. housebuilder Taylor Wimpey and energy group Centrica are all reporting results.

And over in Threadneedle Street, staff at the Bank of England are starting a three-day strike in a pay dispute.

The agenda

- 9am BST: Eurozone manufacturing PMI reports for July

- 9.30am BST: UK manufacturing PMI for July

- 10am BST: Eurozone growth figures for Q2 2017 (first estimate)

- 3pm BST: US manufacturing PMI for July

Updated