Need something explained?Let us know which of these questions we can answer for you.

Thanks, we’ll send you the answer soon.

Thanks, we’ve registered your vote.

Thanks, we’ll send you the answer soon.

Thanks, we’ve registered your vote.

Thanks, we’ll send you the answer soon.

Thanks, we’ve registered your vote.

GDP: What the experts predict

Many City economist have warned that today’s UK growth figures may show little improvement on the first quarter of this year.

Danske Bank’s Kristoffer Kjær Lomholt says:

We estimate the economy expanded by 0.3% quarter-on-quarter, which is not much stronger than the 0.2% q/q growth rate in Q1 (the weakest among the EU member states). The main reason is that private consumption has slowed, as the weaker pound is eroding consumer purchasing power.

Royal Bank of Canada have cut their growth forecast from 0.4% to 0.3%. Here’s why:

After considering the pattern of activity in construction and industrial production in April and May, and the headwinds for the consumer that have been constraining elements of service sector growth, we now consider that it would take an unlikely combination of positive news across all sectors in June to get to growth of 0.4% q/q overall.

Howard Archer, chief economic adviser to EY Item Club, also expects growth of around 0.3%:

“It looks odds-on that whatever growth the UK managed to eke out in the second quarter will have been solely due to the services sector.

“This does appear to have seen some pick-up in activity after a particularly weak first-quarter performance.

“Industrial production and, especially, construction output both fell month-on-month in April and May, and were clearly on course for contraction over the second quarter.

“Despite decent overall manufacturing surveys for June, we suspect industrial production could have contracted by around 0.4% quarter-on-quarter in the second quarter while construction output may have fallen by around 1.7% quarter-on-quarter.

The agenda: It’s UK GDP Day

Good morning!

We’re about to discover how well, or badly, Britain’s economy performed in the last three months.

New GDP data, due at 9.30am, will give the first official insight into UK growth in the second quarter of 2017. It will show whether the economy bounced back from its slowdown at the start of the year, or is still stuck in a soft patch.

And the figures may reinforce fears that the economy has lost momentum this year.

The City’s top number crunchers predict that the economy expanded by between 0.2% and 0.4% in April-to-June, with a consensus of +0.3% growth. Industrial production and construction are expected to have struggled.

That would be little better than in Q1, when GDP rose by just 0.2%. That made Britain the slowest-growing G7 economy, as consumer-facing industries shrank and household spending was hit by rising prices.

Many economists fear that Britain’s economic fundamentals are deteriorating, as Brexit uncertainty hits business investment and the weak pound pushing up inflation.

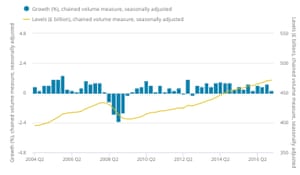

But more optimistically, Britain’s economy has already racked up 17 quarters of growth in a row. That should become 18 quarters today (unless something very nasty happened….)

UK GDP Photograph: ONS

We’ll bring you the GDP data at 9.30am, followed by instant reaction and analysis through the day, plus any other major economic and financial events.

The agenda:

- 9.30am BST: First estimate of UK growth in Q2 2017

- 3pm BST: US new home sales figures

- 7pm BST: US Federal Reserve’s decision on American interest rates and stimulus programme

Updated