The euro is dipping this morning, down 0.2% against the pound at 88.4p.

That suggests that traders expect the European Central Bank to calm expectations that it might rein in its stimulus programme soon, at tomorrow’s meeting.

Benjamin Schroeder, a rates strategist at ING, believes the ECB have had a rethink after president Draghi gave an upbeat speech in late June. Those upbeat comments drove the euro up, and sparked a selloff in eurozone government bonds.

Schroeder adds (via Reuters):

“A strong euro has also raised expectations that they will not sound overly hawkish.”

The US dollar’s weakness has boosted the Chinese yuan.

Beijing just fixed its currency at the strongest level in nine months, as Trump’s healthcare woes continue to weigh on the greenback.

This news clearly calls for a cute panda…

Haidi Lun 伦海迪

(@HaidiLun)Hey guys, remember the yuan fixing? Today’s was the strongest since Oct 2016, 6.7451 vs 6.7611 with $BBDXY weakest since Aug 2016 CNY $CNH pic.twitter.com/xZIfLZnZ0I

Updated

The agenda: Investors await ECB and BoJ tomorrow

A trader yawns on the Frankfurt stock exchange.

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

There’s an end of term feeling in the markets today.

I don’t think any traders have actually turned up with a Kerplunk set, but they could be forgiven for risking a quick game of Top Trumps across their trading terminals.

In short, there’s not much going on today.

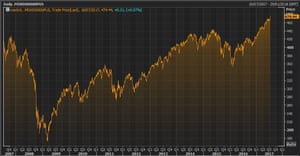

So with nothing to scare investors right now, global markets remain at their highest ever levels. MSCI’s gauge of shares around the world has risen this morning, putting it on track for its fifth daily rise in a row.

The MSCI ‘All Country World Index’ Photograph: Reuters

But although the summer lull is nearly upon us, we’re not there quite yet, class.

Investors need to prepare for a busy Thursday, when the Bank of Japan and the European Central Bank both hold monetary policy meetings. They could move move the markets, if policymakers offer any hints that monetary policy will be tightened soon.

In particular, the ECB could provide fresh guidance on when it will start to taper its bond purchase scheme. Any bullish comments from president Draghi could send the euro spiking.

Mihir Kapadia, CEO of Sun Global Investments, says:

Any comments which are perceived are more hawkish then expected could result in further pressure on the US dollar. The dollar is also weaker against the yen and the pound.”

Over in Asia, optimism over China’s economy, following this week’s GDP figures, has pushed shares higher.

Holger Zschaepitz

(@Schuldensuehner)Good morning from Berlin. Global stocks retest record highs. Asia mkts rise on China optimism. #Euro bulls cautious ahead of ECB on Thursday pic.twitter.com/epX0z2jEs8

The US dollar is languishing around a 10-month low today, following Donald Trump’s inability to get healthcare changes though Congress.

Investors are increasingly sceptical that that the president can implement tax reforms or push through a big infrastructure spending bill.

As Michael Hewson of CMC Markets puts it…

The Trump administration is also helping by appearing to undermine the US dollar at every available opportunity with what can only be described as either incompetence or sheer stupidity. Another failure to enact policy reforms this time on health care is raising serious questions as to whether this administration will deliver on any of the promises it made at the end of last year, with serious doubts now being expressed about tax and banking reform.

It seems that even with a majority in both Houses the Republicans appear unable to even agree amongst themselves as to what is best for the US economy. It appears that the US government is giving the UK government a run for its money in the incompetence stakes. It doesn’t help that neither country has a competent opposition to offset this.

President Draghi will certainly have his work cut out in keeping a lid on the euro at this rate, as the market gears up for tomorrow’s ECB rate meeting, with a move to the $1.2000 level a distinct possibility on a break of $1.1620 and last year’s high.

The agenda:

It looks like a quiet day, but we do get new eurozone construction figures, US housing data, and new oil inventory figures this afternoon….

- 10am BST: Eurozone construction output for May

- 1.30pm BST: US housing starts and building permits

- 3.30pm BST: US crude oil inventories

Updated