Pound hits eight-month low against the euro

We have bad news for any Brits heading over the channel this summer holidays.

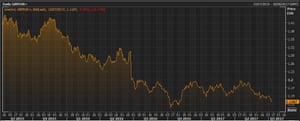

The pound has hit its lowest level against the euro since November 2016, following Ben Broadbent’s dovish comments.

Sterling has weakened to €1.1187, which means one euro is worth 89.4p.

As this chart shows, the pound was worth €1.30 before last June’s EU referendum.

The pound vs the euro over the last two years Photograph: Thomson Reuters

Updated

Lee Hardman, an analyst with MUFG in London, agrees that an August rate rise now looks less likely, which is why sterling has fallen.

He says (via Reuters)

“[The pound] is definitely trading on a softer footing after this news.

“For anyone who had any expectation of an August hike – that is clearly looking very unrealistic now, although he does reinforce that they are moving towards a hike. That will help keep alive expectations for a move later this year.”

Sterling hits two-week low

The pound has fallen to a two-week low after Ben Broadbent revealed he isn’t ready to vote for a rate hike.

Sterling shed 0.2% to hit $1.2821, its lowest level since late June, as the prospects of a rate rise in August receded.

Joe Easton

(@marketsjoe)Early pound weakness on latest Broadbent comments #BoE https://t.co/DBROrZvMFi pic.twitter.com/SW4TbWBUXQ

Philip Shaw of Investec reckons the BoE is now certain to leave interest rates on hold at their current record low, at next month’s meeting.

Philip Shaw

(@philipshaw8)Deputy BoE Gov Ben Broadbent tells Aberdeen press he is not ready to raise rates yet. That should seal a ‘no change’ decision on 3 Aug. #BoE

DailyFXTeamMember

(@DailyFXTeam)BoE’s Broadbent: Too Many Imponderables To Back Interest Rate Hike: UK regional press.

Broadbent: I’m not ready to raise interest rates

There’s early drama in the markets today, as Bank of England deputy governor Ben Broadbent declares that he is not ready to vote to raise interest rates.

Speaking to the Press and Journal in Aberdeen, Broadbent declared that there are too many “imponderables” about the state of the UK economy.

And that makes it “very difficult” for the monetary policy committee to judge if business confidence is strong enough to support higher borrowing costs.

Here’s a flavour of the report:

Highlighting the “mood of business” as the key factor in his thinking, he said: “If you look at the past six to 12 months, economic growth has been okay and the employment rate good. Unemployment has drifted down a little … and inflation is higher.

“There is reason to see the committee moving in that direction (higher interest rates) – but there are still a lot of imponderables.”

It’s an important intervention. At least two Bank of England policymakers are likely to vote for a rate hike in August, so Broadbent is seen as one of the centrist voices who could swing the decision.

As Broadbent puts it:

“In my opinion, it is a bit tricky at the moment to make a decision (to raise rates). I am not ready to do it yet.”

Sigma Squawk

(@SigmaSquawk)Bank of England Broadbent sending #GBPUSD lower. #dove pic.twitter.com/gxwqh2vMZZ

It’s quite a scoop for the P&J. The City had expected Broadbent to declare his hand yesterday, when he gave a speech in Scotland’s oil capital.

Instead, he avoided monetary policy issues, sticking to trade issues – and warning that Britain would suffer badly if trade with the EU was materially affected by Brexit.

Updated

The agenda: UK unemployment in focus after Moody’s warning

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Britain’s cost of living squeeze could worsen today when the latest unemployment statistics are released.

City economists fear that wage growth slowed again in the last quarter, to just 1.8% in the three months to May.

If they’re right, that means real wages are shrinking at a faster pace (as inflation hit 2.9% in May), meaning many households will find it even harder to make ends meet.

Analysts at Royal Bank of Canada say:

The real inflation story in the UK is not the recent pickup in headline CPI inflation, but the failure of earnings growth to follow.

Today’s labour market data will likely see headline earnings growth fall well below 2% y/y, leaving wage growth more than 1% point below CPI inflation.

Economists also expect that the UK unemployment rate will remain at 4.6% – the lowest in over four decades, with an extra 120,000 people joining the labour force.

That sounds like a strong labour market; but it simply isn’t feeding through to pay packets.

Overnight, ratings agency Moody’s warned that Britain’s economy will lose momentum this year amid squeezed living standards and uncertainty over Brexit.

There could be excitement in Canada too. The Bank of Canada is widely expected to raise interest rates today, for the first time in seven years.

And Federal Reserve chair Janet Yellen is testifying to the House Financial Services Committee, on the state of the US economy. She’s likely to stick to her position that the US economy is recovering, having raised interest rates last month.

The agenda:

- 9.30am BST: UK unemployment data

- 10am BST: Eurozone industrial production for May

- 1.30pm BST: Janet Yellen’s statement to the House Financial Services Committee

- 3pm BST: Bank of Canada interest rate decision

- 3pm BST: Janet Yellen’s testimony begins

Ipek Ozkardeskaya

(@IpekOzkardeskay)Quick glance at #UK labour data, #Yellen testimony, #BoC pic.twitter.com/SuJZxY1SbJ