Spanish PMI falls, but still strong

Breaking: Spain’s factory data has missed forecasts, but still shows solid expansion.

The Spanish manufacturing PMI has come in at 54.7, down from May’s 55.4.

Spanish factory bosses reported that output, new orders and employment all rose last June, but not as quickly as the previous month.

Firms reported that their backlog of work stacked up, even though they kept hiring staff.

And the good news for consumers is that raw material inflation is slowing.

Andrew Harker, senior economist at IHS Markit said:

“June saw a continuation of the recent strong performance of the Spanish manufacturing sector, with growth remaining elevated. The first half of the year has been impressive, with no real sign among the latest data that rates of expansion are running out of steam heading into the second half.

“One thing that is on the wane is inflation, with both input costs and output prices rising at the weakest rates since late-2016. This should help firms maintain competitive pricing, enabling them to take advantage of improving customer demand.”

Frederik Ducrozet

(@fwred)Spanish manuf PMI headline index down but sill no sign of cooling. Output, new orders up; employment at near-record high.

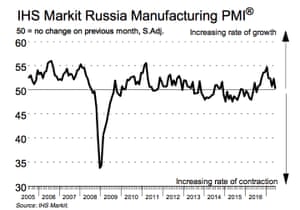

The Russian PMI is a worry.

Growth in Russia’s manufacturing sector almost fizzled out last month, with its PMI dropping to an 11-month low of 50.3, from May’s 52.4.

Markit reports that new business from abroad continued to shrink, forcing Russian factory bosses to lay off staff at the second-fastest rate since last September.

Russian PMI Photograph: Markit

Nordic PMIs sparkle

Norway’s manufacturing base just posted its strongest growth in five years, according to its PMI report:

Kristoffer Lomholt

(@lomholt10)🇳🇴#Norway

Manufacturing #PMI reaching the highest level since March 2012 => fine details => points to further acceleration in manufacturing! pic.twitter.com/XzwVxbOhwD

Sweden factories also accelerated last month, with a PMI of 62.4 — a level showing robust growth.

Value’s Vector

(@pulpmarkets)tEconomics: #Sweden Swedbank Manufacturing PMI at 62.4 https://t.co/dWPLvAZMek pic.twitter.com/DnA8UikulB

Martin Enlund

(@enlundm)$SEK: Swedish PMI better than expected, helped not only by a robust macro momentum in Europe, but also by delayed krona weakness pic.twitter.com/oP3b3TSkkV

Other Asian countries have followed China’s lead, and reported manufacturing growth last month.

Reuters has the details:

Factory Purchasing Managers’ Indexes for South Korea, Japan,Taiwan Vietnam and India all remained above the 50-mark that separates contraction from expansion on a monthly basis.

And all of these indexes, except for Japan and India, rose from the previous month, indicating an acceleration in expansion.

Metal prices have jumped this morning, following the news that Chinese factories returned to growth last month. Aluminium and copper are both rallying.

Christian Fromhertz

(@cfromhertz)$DBB BASE METALS: Aluminum Extends Rally as China PMI Beats Estimates$HG_F #copper #aluminium pic.twitter.com/y18QSVk94v

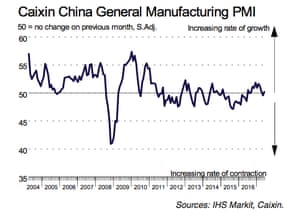

Chinese factory growth recovers, but worries remain

A steel factory in Wu’an, Hebei province, China. Photograph: Thomas Peter/Reuters

China got PMI Day off to a decent start, by reporting its fastest factory growth in three months.

The Caixin/Markit Manufacturing Purchasing Managers’ index rose to 50.4 in June, better than expected. That’s up from May’s 49.6 – which was the worst reading in 11 months.

Any PMI over 50 signals growth, so it’s an encouraging sign for China’s manufacturing sector after some tricky months.

Chinese PMI Photograph: Markit

The details are a bit mixed, though. Chinese companies reported that their production levels rose last month, and new orders also picked up.

But with demand still muted, they cut their workforce levels again and also ran down their inventories, as optimism over the business outlook hit its lowest level of 2017.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, is concerned that Chinese factories could struggle later this year.

“The manufacturing sector recovered slightly in June, but based on the inventory trends and confidence around future output, the June reading was more like a temporary rebound, with an economic downtrend likely to be confirmed later.”

Updated

The agenda: UK and eurozone factory reports

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

We’re getting a healthcheck on the world’s factories today, as data firms release their monthly Purchasing Managers Index reports.

This flurry of data will show how manufacturers – from China’s Pearl River Delta to Germany’s Mittelstand and the US Rust Belt – fared in June, hopefully giving a new insight into the health of the global economy.

Darts

(@Macroandchill)Happy PMI day!

Economists expect another strong month from Europe, as its recovery continue. The eurozone manufacturing PMI is tipped to stay at 57.3, a level that shows the strongest growth since the debt crisis began.

The British data could show a slowdown, though – with the UK manufacturing PMI forecast to fall to 56.3, from 56.7.

The UK report will be closely scrutinised for signs that June’s general election, and the resulting hung parliament, has hit industry.

Royal Bank of Canada explain:

With more hawkish noises coming from certain quarters of the Bank of England’s Monetary Policy Committee in recent days, markets are likely to be especially sensitive to the PMI surveys this month.

As they were conducted mid-month in June, it should be expected that the results incorporate businesses’ views about the impact of the indecisive general election result on 8 June.

The Chinese data is already out, showing that growth hit a three-month high (more on this shortly).

We also get new eurozone unemployment figures this morning; they may show that the jobless rate remains at its lowest level since the financial crisis, at 9.3%.

RANsquawk

(@RANsquawk)Looking ahead, highlights include Eurozone, UK and US mfg PMIs, US ISM and construction spending.

European stock markets are expected to open higher, after being rattled last week by confusing signals from the world’s central bankers about the path of monetary policy.

And this afternoon, the Financial Stability Board, which monitors the state of the global financial system, will talk about its work for the G20 on financial stability. The FSB is chaired by Bank of England governor Mark Carney.

The agenda:

- 8.15am BST: Spanish manufacturing PMI

- 8.45am BST: Italian manufacturing PMI

- 8.50am BST: French manufacturing PMI

- 8.55am BST: German manufacturing PMI

- 9am BST: Eurozone manufacturing PMI

- 9.30am BST: UK manufacturing PMI

- 10am: Eurozone unemployment for May.

- 1pm: FSB publishes report to G20 about financial stability reforms

- 2.45pm-3pm: Two US manufacturing PMI reports

Updated