Sign up to our email

Guardian Business has launched a daily email.

Besides the key news headlines that you’d expect, there’s an at-a-glance agenda of the day’s main events, insightful opinion pieces and a quality feature to sink your teeth into each day.

For your morning shot of financial news, sign up here:

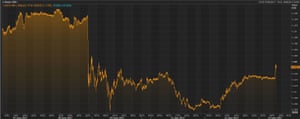

Pound pushes towards $1.28

Sterling is rising in early trading, hitting its highest level since Britain’s shock general election results landed.

The pound has gained a third of a cent to $1.278, as traders brace for this morning’s UK jobs report.

The pound vs the US dollar over the last week Photograph: Thomson Reuters

It’s also a little higher against the euro, at just below €1.14.

The possibility that Britain could now seek a ‘softer Brexit’ from the European Union is helping the pound recover.

FXTM research analyst Lukman Otunuga explains:

Currency investors remained cautiously optimistic over a softer Brexit following last week’s UK election outcome, resulting in a hung parliament.

Although the political uncertainty in the UK and pending Brexit negotiations are still in focus, much attention will be directed towards the UK jobs report this morning.

The agenda: UK jobs report and Federal Reserve decision

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Britain’s cost of living squeeze will be dragged back into the spotlight today, when the latest employment data is released.

City economists fear today’s figures will show that wages are falling further behind inflation, which has been driven up to 2.9% in May by the weak pound (as we learned yesterday).

Basic pay rises (excluding bonuses) are expected to have fallen to 2.0% in the three months to April. That would mean real wages have kept falling this year, bringing more pain to struggling families across the country.

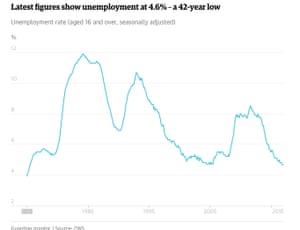

On a more positive note, the unemployment rate may remain at a 42-year low (last month it fell to 4.6% , the lowest since 1975), and the employment total probably kept rising in the last quarter.

RBC Capital Markets say:

Unless last month’s gains somehow turn out to be a total blip, it wouldn’t be too surprising if the level of employment rises again by close to a triple-digit number of thousands in the three months to April.

The rotation of workers out of part-time roles into full-time employment is now an established theme and if we see this trend once more it would imply that slack is being partially eroded as a result of reduced ‘underemployment’.

Last month’s unemployment data Photograph: Guardian/ONS

It’s also a big day for the US economy. America’s central bank, the Federal Reserve, is widely expected to raise interest rates today – to a target range of 1% to 1.25% (from 0.75% to 1%).

Fed chair Janet Yellen will then face the press and give her views on the state of the economy. Wall Street experts predict she’ll try to squash speculation that the Fed is too hawkish.

As Lew Alexander, chief economist at Nomura, put it (via Marketwatch):

“We do expect her to try to be somewhat forceful in conveying…to market participants that their skepticism over hikes after the June meeting may not be warranted.”

Federal Reserve

(@federalreserve)Tomorrow at 2:30 p.m. ET: Chair #Yellen hosts live #FOMC press conference: https://t.co/AknBNh2ef4 pic.twitter.com/mOjT9owfyr

We also get new eurozone unemployment figures, plus new retail sales and inflation statistics from America.

European stock markets are expected to be flattish, as investors hunker down ahead of the Fed decision tonight.

Ipek Ozkardeskaya

(@IpekOzkardeskay)Opening Call at @LCGTrading #FTSE -4 points at 7496#DAX +22 points at 12787#CAC +16 points at 5277#EuroStoxx +4 points at 3561

Here’s the agenda:

- 9.30am BST: UK labour market report

- 10am BST: Eurozone employment report for Q1 2017

- 1.30pm BST: US inflation report for May

- 1.30pm BST: US retail sales for May

- 7pm BST: US Federal Reserve interest rate decision

- 7.30pm BST: Fed chair Janet Yellen’s press conference

Updated