Connor Campbell of SpreadEx agrees that sterling is getting a small lift from the general election:

As Britain heads to the ballot box the markets got off to a relatively quiet start this Thursday, with the pound very gently building on yesterday’s gains.

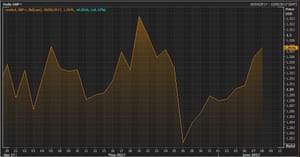

Cable – which, despite some big swings, has been climbing since the beginning of June – rose another 0.2%, sending sterling to a its best price in a fortnight. Against the euro the pound has been less successful of late; nevertheless, despite being a long way from recovering the losses it has incurred since mid-May, a 0.1% increase has nudged the currency to a one and a half week peak. The pound is assumedly benefiting from the final round of polls, all of which – to varying degrees – point to a Tory win.

Pound hits two-week high on election day

The pound has hit a two-week high in early trading, as City investors anticipate a Conservative win in today’s general election.

Sterling has hit $1.2976, its highest level since 25 May, after the last wave of opinion polls suggested that Theresa May is heading back to Number 10 Downing Street with a larger majority.

As this chart shows, the pound has been wallowing below $1.30 in mid-May, as the election campaign heated up and investors started wondering if Britain could end up with a hung parliament.

The pound vs the US dollar Photograph: Thomson Reuters

But late last night, YouGov reported that the Conservatives have a seven-point lead over Labour:

YouGov

(@YouGov)YouGov FINAL TIMES POLL for #GE2017

CON 42%

LAB 35%

LD 10%

UKIP 5%

GRN 2%

OTH 6%

(Fieldwork 5-7 June)https://t.co/QMKkFRU0ue pic.twitter.com/lbcnmdocO9

Sterling traders are now pricing a Theresa May victory, says FXTM chief market strategist Hussein Sayed:

The higher the margin Conservatives win by, the more negotiation power May will have on Brexit terms, and the higher the Pound goes from here.

The agenda: It’s Triple Threat Thursday

The Golden Pheasant Public House in Lower Farringdon, Hampshire, which is being used as a polling station today. Photograph: Andrew Matthews/PA

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

They’re calling it Triple Threat Thursday in the City. A pivotal day lies ahead, with plenty of political and economic drama in Europe and the US that could send the markets lurching.

In the City, investors are on edge as Britain heads to the polling stations. The latest opinion polls point to a Conservative victory, and an increased majority for Theresa May — but a shock result could have seismic impact on shares and the pound.

It’s also a big day for the European Central Bank as its governing council holds a monetary policy meeting. Investors had been expecting the ECB to take its first step towards tightening monetary policy, by tweaking the language in its outlook statement.

However, leaks yesterday claimed that the ECB is actually going to revise down its inflation outlook — making any exit from its stimulus programme even less likely.

ECB president Mario Draghi will reveal all in his eagerly awaited press conference at lunchtime.

We also get updated eurozone GDP figures, which could possibly see growth revised UP to 0.6% in the last quarter, from 0.5%, so it could be a volatile day for the euro.

The third threat? Former FBI boss James Comey’s testimony to Congress (from 3pm BST).

It could be a historic event, with Comey facing questions from the Senate Intelligence Committee over the investigation into ties between president Trump and Russia.

Our world affairs editor Julian Borger explains why it really really matters:

When James Comey, the former FBI director, stands before a Senate committee on Thursday to give evidence about the president who fired him, it will be one of the most dramatic moments in US political history.

The stakes will be as high as they have ever been at a congressional hearing. The questions Comey will be asked by the Senate intelligence committee include whether Donald Trump tried to persuade him to stop an investigation into improper contacts between a top adviser and Russian officials, whether Trump sought to extract a vow of personal loyalty, and whether Comey was fired because he did not comply.

Trump has denied trying to make Comey drop the case, but if Comey contradicts him and is supported by other evidence, it would represent potential obstruction of justice by the president and mark a long leap down the road towards impeachment.

Even in the Teapot Dome scandal that shook Warren Harding’s administration in the early 1920s, and in the Watergate affair half a century later, it was not alleged that the president himself tried to intimidate an investigator….

More here:

Comey’s prepared statement has already set the scene, showing that president Donald Trump pressured him to shut down an investigation into a senior adviser’s links to Russia.

Here’s the economic agenda:

- 10am BST: Eurozone GDP figures for Q1 2017 (latest estimate)

- 12.45pm BST: European Central Bank’s monetary policy decision

- 1.30pm BST: ECB president Mario Draghi’s press conference

- 1.30pm BST: US weekly jobless claims

Updated