Qatar has hit back at Saudi, Bahrain, the UAE and Egypt, accusing them of lying over their decision to cut diplomatic ties today.

In a statement, the Qatari foreign ministry says:

“The campaign of incitement is based on lies that had reached the level of complete fabrications.”

Jasper Lawler of CMC Markets explains why crude prices have risen today:

The price of oil could be on the verge of another recovery with political tensions between Saudi Arabia and Qatar a potential threat to supply out of the Strait of Hormuz.

A wave of selling has swept through Qatar’s stock market at the start of trading, sending its benchmark index tumbling by 6%.

David Ingles

(@DavidInglesTV)Qatar benchmark stock index plunges 5.5% after Saudi, U.A.E., Egypt and Bahrain sever ties with the country.https://t.co/3ZOukO5ZI3

Oil price surges as Gulf states cut Qatar ties

The oil price has jumped this morning after a group of Gulf states cut diplomatic relations with Qatar.

In a dramatic development Saudi Arabia, Egypt, the United Arab Emirates and Bahrain all announced early today they were severing ties with Doha and calling their diplomatic staff home.

They accused the Qatar leadership of supporting terrorism in the region, and destabilising the Gulf, through its support for Islamist groups and its relations with Iran.

Peter Hoskins

(@PeterHoskinsTV)Saudi Arabia, Bahrain, Egypt cut diplomatic ties with Qatar, escalating crisis over Qatar relationship with Iran, Muslim Brotherhood support

Associated Press explains:

Saudi Arabia said it took the decision to cut diplomatic ties due to Qatar’s “embrace of various terrorist and sectarian groups aimed at destabilizing the region” including the Muslim Brotherhood, al-Qaida, the Islamic State group and groups supported by Iran in the kingdom’s restive eastern province of Qatif. Egypt’s Foreign Ministry accused Qatar of taking an “antagonist approach” toward Egypt and said “all attempts to stop it from supporting terrorist groups failed.”

The tiny island nation of Bahrain blamed Qatar’s “media incitement, support for armed terrorist activities and funding linked to Iranian groups to carry out sabotage and spreading chaos in Bahrain” for its decision.

The four countries are suspending air and sea travel, and Saudi Arabia is also cutting its road crossings.

As this map from Bloomberg shows, this would block Qatar from accessing the rest of the region by land.

Photograph: Bloomberg

Energy traders were quick to respond to the escalating crisis, sending Brent crude up by $1 per barrel to $50.42.

Qatar is the biggest supplier of liquefied natural gas (LNG), and those supplies could potentially be disrupted if this row deepens.

Holger Zschaepitz

(@Schuldensuehner)Oil jumps after Saudi Arabia, Egypt, United Arab Emirates & Bahrain severed their ties w/ Qatar, accusing Gulf state of supporting terrorism pic.twitter.com/69eD7aep37

RANsquawk

(@RANsquawk)Middle east tensions see crude prices jump over 1% as several nations cut ties with Qatar.

Updated

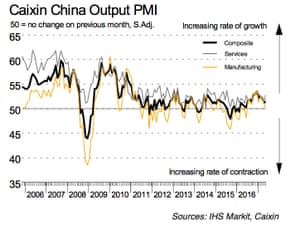

Chinese services sector growth hits four-month high

China’s service sector has posted its fastest growth in four months, in an encouraging signal following some weak factory data last week.

Data firm Caixin reports that Chinese firms were boosted by a jump in new business last month, as client demand strengthened.

This sent the Chinese services PMI up to 52.8 in May, up from 51.5 in April, which is the highest reading since January.

That’s a boost to the region, especially as China’s manufacturing sector shrank in May.

Chinese service sector PMI Photograph: Caixin

While service sector companies took on more workers, manufacturing firms continued to pare back staff numbers, at the fastest rate since last September.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, says:

“The improvement in the services sector bolstered the Chinese economy in May. However, the rapid deterioration in the manufacturing industry is worrying. We need to closely monitor whether the diverging trends in manufacturing and services will widen further.”

The agenda: Service sector data due

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Investors are bracing for a barrage of data showing how service sector companies in Europe and America performed last month.

Economists expect to see another strong performance from eurozone firms; growth is expected to remain around its highest level since the financial crisis.

The UK services report will also be closely scrutinised, for signs that political uncertainty is hurting the economy. The City expects that growth slowed last month, taking the UK services PMI down to 55.0, from 55.7.

CMC’s Michael Hewson reminds us that last week’s factory data was encouraging, so perhaps today’s report will bolster optimism.

On the data front the picture was more positive with manufacturing PMI’s continuing to be resilient in May, with the hope that today’s services PMI numbers will be similarly good.

Elsewhere, the oil price is climbing after a group of Gulf countries cut ties with Qatar, saying it was supporting terrorism in the region.

And the pound could be jittery, with just three days until the UK general election. New figures showing how many new cars were sold last month.

Here’s the agenda:

- 8.15am-9am BST: Eurozone Service sector PMIs

- 9am BST: UK car registration figures for May

- 9.30am BST: UK service PMI

- 2.45pm-3pm BST: US services PMIs