Pound hit by hung parliament predictions

A new forecast that Britain could be left with a hung parliament next week has knocked the pound.

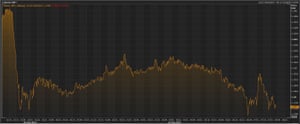

Sterling fell below $1.28 after YouGov analysis , published in The Times, suggested that Theresa May could be left 16 seats short of an overall majority.

This prediction has caused some alarm in the foreign exchange markets, where traders had been expecting that the Conservatives would secure a large majority.

Naeem Aslam, chief market analyst at Think Markets, explains:

In the currency market, it is the British Pound which has attracted the most attention as the latest polls from YouGov shows that the big gamble by Theresa May could cost her majority lead in parliament. This is not something which she has pictured but again, the same story goes for David Cameron when he took the gamble for the Brexit vote. The YouGov poll shows that her party could lose as much as 20 seats and Labour could gain nearly 30 additional seats. So much for all the rhetoric “making her hand strong in the parliament”.

This has taken a toll on the British pound, and it has lost ground against a basket of currencies.

The pound vs the dollar since 10pm last night Photograph: Thomson Reuters

Aslam believes the pound is vulnerable to further losses too:

Investors are worried about a hung parliament, and if we get more polling data which confirms that the possibility of a hung parliament is more real, we could see the British pound losing ground against the dollar and the Euro. We do think that the sterling-dollar pair could drop all the way to 1.26 mark if we break the support of 1.2752.

Sam Coates Times

(@SamCoatesTimes)Tonight: we reveal YouGov’s first seat by seat projection of the campaign – suggests Tories fall 16 seats short of overall majority pic.twitter.com/8ouPRHTZ7m

YouGov’s forecasts is controversial, though, as polling companies don’t usually produce these kind of seat-by-seat projections.

And The Times itself admits that the estimates has plenty of wiggle room, saying:

“The poll allows for big variations, however, and suggests that the Tories could get as many as 345 seats on a good night, 15 more than at present, and as few as 274 seats on a bad night,”

But still, it’s enough to get traders jittery…..

IGSquawk

(@IGSquawk)The pound is trading below $1.28 this morning as new poll suggests Theresa May could fall short of a majority. AB9 #GE2017 #GBPUSD

Updated

The agenda: eurozone inflation and jobs report

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Today we’ll be watching the pound closely, as Britain’s general election campaign enters the final stretch ahead of the June 8 dash to the polls.

The latest opinion polls are painting a mixed pictures; some suggest a solid Tory majority, others reckon Theresa May could even lose seats, so it’s a testing time to be a currency trader.

New economic data from the eurozone will hit the wires this morning. It’s likely to show that Europe kept creating jobs last month, as the recovery from the debt crisis continues.

The eurozone’s inflation rate probably also fell sharply this month; taking some of the heat off the European Central Bank to consider tightening its stimulus programme.

Canada will also be in focus later, when its first quarter growth figures are released. It’s likely to have been one of the best-performing advanced economies in Q1, outpacing the UK.

The agenda:

- 8.55am BST: German unemployment figures for May; the jobless total is expected to fall by around 15,000

- 10am BST: Eurozone unemployment figures for April; the jobless rate is expected to drop to 9.4% from 9.5%

- 10am BST: Eurozone inflation figures for May; CPI rate is expected to drop to 1.5% from 1.9%

- 1.30pm BST: Canadian GDP for the first quarter of 2017; economists predict annualised growth of around 4%

Updated