British Airways IT crisis hits IAG shares

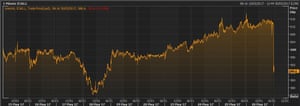

Shares in British Airways’ parent company have slumped to the bottom of the London stock market this morning, after a long weekend of disruption.

International Airlines Group’s shares fell by 4% at the start of trading, as investors try to calculate the cost of the IT problems that disrupted hundred of flights.

IAG’s share price Photograph: Thomson Reuters

BA cancelled all its flights from Heathrow and Gatwick (London’s two largest airports) on Saturday, and there were further delays on Sunday as the airline battled to recover the situation.

Experts reckon the compensation bill could hit £100m, but the long-term impact of the crisis is hard to assess.

BA blamed a power supply outage, and denied that a cyberattack was to blame. But unions pointed out that BA has made hundreds of IT staff redundant recently.

Kathleen Brooks, research director at City Index, believes BA’s reputation could be significantly damaged by the crisis:

Even if you give BA the benefit of the doubt it still looks bad, if their systems are not strong enough to withstand a power surge, then this sort of thing could happen again, which could add downward pressure to the IAG stock price.

Although cost cutting has been good for the share price in the last year, it will come back to bite IAG if it stops them from doing what they are supposed to do: fly passengers to their destinations.

Greece’s government has scrambled to deny Bilt’s report that it might default on its next debt repayment in July.

Reuters has the details:

A Greek government spokesman denied a German newspaper report on Tuesday that it was considering opting out of a loan repayment in July if lenders could not agree on debt relief.

“It is not true,” government spokesman Dimitris Tzanakopoulos told Reuters. “There will be a solution on June 15.”

Efthimia Efthimiou

(@EfiEfthimiou)#Greece denies report it may opt out of July debt repayment https://t.co/yv8FLISK2w

French growth revised up to 0.4%

Newsflash: France’s economy is growing faster than first estimated.

Statistics body INSEE has reported that French GDP expanded by 0.4% in January-March, up from the 0.3% first estimated.

That means France grew twice as fast as the UK in the first three months of this year.

And in another boost for new president Emmanuel Macron, French consumer confidence is now rising at its fastest rate in a decade.

INSEE’s index of consumer morale has jumped to 102 in May, up from 100 in April, wth households saying they’re more optimistic about the economic situation.

Mark Deen

(@MarkJDeen)French first quarter GDP revised up (investment) & consumer confidence highest since 2007, the year Sarkozy took office: pic.twitter.com/mQC4VSQWYv

Euro falls as Greek debt fears mount

Growing concerns over Greece’s bailout programme are weighing on the euro this morning.

The European single currency has shed almost 0.5% to $1.113, on concerns that Athens and its creditors may not reach an agreement over its bailout programme in time.

Overnight, finance minister Euclid Tsakalotos warned that Greece’s delicate recovery would be derailed if eurozone finance ministers didn’t agree to release its next loan in June.

Tsakalotos told journalists in Athens that Greece deserves to be given the debt relief promised by its lenders, if it stuck to its austerity programme.

He said it is now vital that a real is reached on June 15, adding:

“We can’t accept a deal which is not what was on the table.

What was on the table was if Greece carried out its reform package then creditors would ensure that there would be a clear runway through clarity for debt.”

Greece had hoped to receive its latest bailout payment this month, but eurozone ministers couldn’t reach an agreement with the International Monetary Fund.

Athens faces €7bn of debt repayments this summer, so there is concern that the eurozone debt crisis could flare up again soon.

Germany’s Bilt newspaper is claiming this morning that it might ‘skip’ this bill, if a deal on debt relief hasn’t been reached. That’s added to the anxiety this morning:

Christophe Barraud

(@C_Barraud)#Greece (3) | May Opt Out of Next Payment Without Debt Deal – Bloomberg (citing Bild) pic.twitter.com/DuKFicoLiY

The euro is also suffering from worries over Italy, where former prime minister Matteo Renzi is pushing for early elections – perhaps in September.

The agenda: Election weighs on the pound; eurozone data

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The pound is dipping in early trading today as anxiety over next month’s general election continues to build.

Sterling is down 0.2% this morning at $1.281, after a new opinion poll showed that the Conservatives have a lead of just six percentage points over Labour.

After a similarly tight YouGov poll last week, City investors are less confident

Lord Ashcroft

(@LordAshcroft)Survation Poll. CON 43% LAB 37% LDEM 8% UKIP 4%…

John Clancy

(@johnclancy)Survation poll leaked out early: Con 43% (nc) Lab 37% (+3). Labour on higher than Con at 2015 Election &Con lead narrower than 2015 Election

Last night, prime minister Theresa May and Labour leader Jeremy Corbyn both faced off against veteran political journalist Jeremy Paxman.

Both sides are (predictably) claiming victory, after a robust (but not desperately enlightening) encounter that saw Corbyn deny being a dictator, and May accused of being “a blowhard who collapses at the first sign of gunfire”.

The London stock market is expected to drop a little when trading resumes after the Bank Holiday weekend, having hit a record high on Friday night.

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7537 -0.15%

$DAX 12628 -0.01%

$CAC 5317 -0.30%$IBEX 10865 -0.18%$MIB 20777 -0.03%

We also get a raft of new eurozone economic data this morning, that may show if the European recovery is on track.

Here’s the agenda:

- 7.45am: The second estimate of French GDP for Q1 2017 is released.

- 10am: Eurozone economic confidence figures for May are published; economists expect another strong reading

- 1pm: German inflation figures for May are published, and may show that the CPI rate fell to 1.6%, from 2% in April

- 2pm: The S&P/Case Shiller index of US house prices is released

- 3pm: US consumer confidence figures for May

Updated