Brexit will ‘stall’ City of London, Goldman Sachs warns

Lloyd Blankfein

Another Brexit warning, this time from the chief executive of Goldman Sachs, the world’s second largest investment bank.

Lloyd Blankfein said London’s financial centre would “stall” due to the turmoil of the Brexit process.

He told the BBC:

[The City] will stall, it might backtrack a bit, it just depends on a lot of things about which we are uncertain and I know there isn’t certainty at the moment. I don’t think it will totally reverse.

Blankfein said that he was hoping to avoid moving large numbers of staff out of the UK, but added the bank had held discussions in a number of European cities as part of Brexit contingency plans.

“We don’t have big plans now, we are looking – we are trying to avoid [it].

Obviously, a lot of people elect to have their European business concentrated in a single place, and the easiest place, certainly, for the biggest economy in the world [America] to concentrate would be the UK – the culture, the language, the special relationship, and we are an example of that.

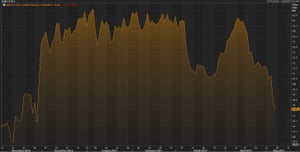

The price of Brent crude oil has not been lower since November 2016, before Opec’s last agreement on production caps.

Oil prices have fallen to the lowest level in more than five months

The FTSE is expected to open lower this morning:

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7236 -0.17%

$DAX 12632 -0.12%

$CAC 5361 -0.21%$IBEX 11016 +0.03%$MIB 21141 -0.13%

The agenda: oil prices fall; US non-farm payrolls day

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Brent crude is down a further 2% this morning at $47.51 a barrel, the lowest level in more than five months.

So the sharp sell-off that began yesterday continues, and has driven shares lower in Asia, with the Hang Seng down 1% at 24,435.

A combination of concerns about slowing demand from China, rising oil production in the US, and a lack of commitment to further supply cuts from the Opec oil producing nations, are all weighing on prices.

US West Texas Intermediate crude oil was also down 1.9% at $44.66 per barrel.

Another key focus today will be the April non-farm payrolls report in the US, which is due to be published at 13.30 UK time. It is expected to show a pick-up in job creation last month, with 185,000 jobs added, compared with just 98,000 in March. Analysts will also be looking for any revision to that weaker-than-expected March number.