The dollar has also dipped this morning, taking the greenback close to its lowest level in five months.

That’s pushed sterling back over $1.29.

FXTM Chief Market Strategist Hussein Sayed says investors are sceptical that Trump’s proposed cuts will get through Congress:

The lack of details contained on Trump’s single piece of paper was perceived as a publicity stunt for the President as he celebrates his first one hundred days in the Oval Office, and unfortunately, seemed more of a wish list than a serious starting point.

UK bank Lloyds is defying the selloff, with its shares jumping 4% at the open.

The City is impressed that Lloyds has doubled its profits in the last quarter, as its recovery from the financial crisis continues.

But there’s a wrinkle — it has set aside another £350m to compensate customers who were missold PPI, plus £100m for victims of fraud at its HBOS branch in Reading.

Connor Campbell of SpreadEx sums up the problem with Donald Trump’s tax plan – Not Enough Detail!

Alongside cutting corporate tax rates to 15%, Treasury Secretary Steven Mnuchin and National Economic Council director Gary Cohn revealed that the USA’s 7 tax brackets would be reduced to 3, while the alternative minimum tax would be slashed and nearly all of the current tax deductions eliminated.

Yet when pressed for more information, specifically if these reforms would be revenue neutral, the pair came up short, producing some Trumped up rhetoric about how it would pay for itself through ‘growth, reduction of deductions and closing loopholes’ and that the administration had a ‘once in-a-generation opportunity to do something really big’.

Trump disappointment pulls Europe’s markets down

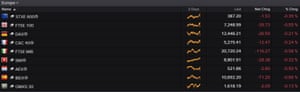

Here’s the damage across Europe’s markets this morning:

European stock markets this morning Photograph: Thomson Reuters

Hopes that Trump’s economic council would offer some surprises in yesterday’s tax plan have been dashed, says Mike van Dulken of Accendo Markets.

He adds:

In focus today will be fallout from Trump’s tax announcement, having disappointed by being merely a proposal framework and still facing the same Congressional hurdle (deficit hawks on both sides of the aisle) that he was unable to clear with Healthcare reform.

European stock markets have fallen at the start of trading as traders give their verdict on Trump’s tax policies.

In London, the FTSE 100 has shed 27 points or 0.4%, while France’s CAC 40 has lost 0.2%.

Photograph: Bloomberg TV

One trader joked that the ‘Trump trade’ has turned into the ‘Trump fade’, as optimism about the president’s policies weakens

Konstantinos Anthis in the ADS Securities research team says:

Investors focused on President Trump’s tax reforms were disappointed by the lack of any real detail.

Robin Bew of the Economist Intelligence Unit isn’t impressed by the lack of detail in the Trump tax plan.

Robin Bew

(@RobinBew)Trump tax plan so thin as to be almost meaningless. Headline grabbing rate reductions with no detail on funding. Long way from being passed

Christopher Hayes of MSNBC thinks a lot more work is needed:

Christopher Hayes

(@chrislhayes)The tax plan unveiled today is like turning in a book proposal to your editor on the day the manuscript is due.

Broadcaster and academic Linda Yueh is also struck by the lack of detail:

Linda Yueh

(@lindayueh)White House unveils dramatic plan to overhaul tax code: plan has less than 200 words and contained just 7 numbers https://t.co/EWDPvEn5MQ

Markets dip on Trump tax disappointment

After all the razzmatazz, Donald Trump’s tax reform plan has left investors rather cold.

If you’re going to promise one of the biggest tax cuts ever, you need to present more than one side of A4 paper peppered with bullet points. So the broad brush policies presented last night haven’t really impressed the City.

Japan’s Nikkei has closed in the red, down 0.2%, and European markets are expected to dip this morning too.

The top line of Trump’s plan includes slashing corporation tax from 35% to 15%, cutting a key tax on the richest Americans, reducing the number of tax brackets, abolishing most tax deductions, and lowering the rate on corporate profits brought back from overseas.

That historic tax reform plan in full…..

But there’s precious little detail about how the plan would be paid for — so critics are quickly calling it a tax cut for the rich.

Michael Hewson of CMC Markets says investors wanted more:

Markets had been hoping for more in the way of specifics, in particular the percentage level of the one-off profits tax, which it is hoped will prompt technology companies to repatriate the billions of dollars in profits currently held overseas, as well as some indications on timings, and how the cuts would be funded.

These still appear to be some way off, and appear unlikely to go through this year, though we may get something on healthcare by the end of the month. In any case the effect on the US dollar is likely to be a negative one given that markets will have to wait a while longer for a repatriation boost.

Updated

The agenda: Waiting for Super Mario

Mario Draghi, President of the European Central Bank. Photograph: Domenic Aquilina/EPA

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

It’s European Central Bank Day, when the world’s investors turn to Frankfurt to listen to Mario Draghi’s view of the eurozone economy.

The ECB is expected to maintain its very loose monetary policy stance today, concluding that inflation and wage pressure remains limited.

But with Europe picking up speed, and the pro-EU Emmanuel Macron expected to become French president, Draghi may face some pressure from hawkish colleagues.

So, we might get some hints that the ECB might tighten policy in the coming months, perhaps as soon as June.

The main decisions on rates and stimulus measures are announced at 12.45pm BST (1.45pm in Frankfurt). Draghi’s press conference is 45 minutes later.

Royal Bank of Canada expects Draghi to take a relaxed approach, saying:

After the market’s ‘hawkish’ interpretation of the March meeting we expect that Draghi will purposely look to strike a more dovish tone in his press conference along the lines of his recent speech to the annual ‘ECB and its Watchers’ conference earlier this month.

He argued that, despite an improving growth backdrop, the conditions under which the ECB could begin to consider tightening policy had yet to be met, meaning that that there was no cause to deviate from the current policy path and forward guidance, including what it implied about the sequencing of policy changes

Also coming up today….

It’s a busy morning for corporate news as the reporting season enters full swing.

Financial groups Lloyds Banking Group and Deutsche Bank, Pharmaceutical firm Astra Zeneca, housebuilders Persimmon and Taylor Wimpey and advertising giant WPP are all reporting results this morning.

Later today, Google/Alphabet, Microsoft, Amazon, Ford and Starbucks will report.

David Buik

(@truemagic68)UK companies posting results – Persimmon, Jardine Lloyd Thompson, Cobham, Agrekko, Astra Zeneca, Weir Group, Schroders, WPP, Katz Minerals

David Buik

(@truemagic68)LLOYDS BANKING GROUP posts Q1 interim management statement today at 7.00am

David Buik

(@truemagic68)US companies posting results – Ford, Raytheon, Zimmer, Bristol Myers Squib, Mead Johnson, CME, KKR, Microsoft, Amazon, Starbucks, AbbVie,

There’s also some economic data which might move the markets

- 10am BST: Eurozone consumer confidence for April

- 11am BST: UK retail sales for April

- 1.30pm BST: US durable goods orders for March

We’ll be tracking all the main news through the day….

Updated