European stock markets will probably have closed before we hear details of Trump’s tax proposals.

According to The Hill, an announcement is expected at 1.30pm Washington time, or 6.30pm BST.

They also predict that Secretary of the Treasury Steven Mnuchin and National Economic Director Gary Cohn will present the plans; Trump is busy meeting Secretary of State Rex Tillerson.

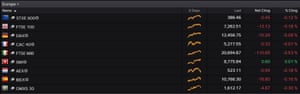

After two solid days, European stock markets are taking a little breather.

The UK, French and German indices have all dipped in early trading:

Photograph: Thomson Reuters

Donald Trump’s tax reforms plans are the number one issue in the City today, says Naeem Aslam of Think Markets.

He sounds a little sceptical about the whole thing, though:

Currently, one major aspect of his plan which everyone is talking about is the corporate rate tax cut to 15% from its current rate of 35%. He can certainly cut that to 15% but that would only be good enough to produce a mammoth headline on the newswire.

But, the question which you need to ask is how long it will take for that tax rate to become effective if it becomes effective at all. The market may go higher on the back of these flashy headlines but it will not take long before reality catches up with it.

Last weekend’s French elections continues to reassure traders, says Chris Weston of IG:

It’s a good time to hold equity and credit and it seems a dark cloud in the form of the French elections has swiftly departed from the investment landscape, combining effectively with headlines on Trump tax reform and in turn providing fresh impetus to chase returns.

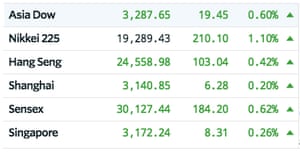

The prospect of sweeping tax reforms in America has helped to drive Asian stock markets higher today.

Japan’s Nikkei has closed 1% higher, and the other main indices are also gaining ground.

Photograph: Marketwatch

The agenda: Optimism keeps rippling through markets

Traders on the floor of the New York Stock Exchange yesterday. Photograph: Spencer Platt/Getty Images

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

There’s a buoyant mood in the markets today, keeping indices at their highest ever levels.

Yesterday the MSCI World Index hit a record high, helped by optimism over European politics and hopes of chunky tax cuts in America.

That sent Wall Street racing last night, with the Nasdaq hitting 6,000 points for the first time ever. And traders expect to hold onto these gains today:

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7284 +0.11%

$DAX 12482 +0.12%

$CAC 5286 +0.16%$IBEX 10793 +0.09%$MIB 20808 +0.01%

Three factors are working together to keep shares up, and thwart those who think the rally has gone two far.

1) The Europe effect. Investors seem pretty convinced that Emmanuel Macron will defeat Marine Le Pen on May 7th, and become France’s next president. Cautious voices point out that Macron faces a serious struggle to get his reform agenda moving – especially if his En Marche! party don’t make big wins in June’s elections.

2) Donald Trump’s tax reforms. The US president is expected to outline fiscal plans today, including slashing corporation tax from 35% to just 15%. That’s alarmed some experts, with one estimating that it could cost $2 trillion in revenue. But lower taxes = higher profits = higher share prices.

There’s also optimism that a budget deal can be reached to prevent a government shutdown, with Trump apparently giving ground over his Mexican Wall plan:

3) Decent corporate earnings. Yesterday, fast food chain McDonald’s and equipment maker Caterpillar both beat forecasts, bolstering hopes that the global economy is on firmer footings.

Mike van Dulken of Accendo Markets explains:

US equity markets continues their sharp jump higher in anticipation of the Trump administration’s tax reform announcement, with the tech-focused Nasdaq trading above 6,000 for the very first time, while both the S&P500 and Dow Jones indices move closer to their respective all-time highs.

Strong Q1 earnings performances from Caterpillar, McDonald’s and DuPont led the Dow over 200 points higher, while the Materials sector led the S&P to within 20 points of a fresh high.

Shane Oliver, head of investment strategy at AMP Capital Investors in Sydney, agrees that “Confidence has returned”, adding:

Markets seem a lot more relaxed. Globally, we’re seeing a lot of risk-on.”

There’s not much in the economic diary today.

On the corporate front, the London Stock Exchange, Jupiter Fund Management, Metro Bank, chemicals firm Croda and German carmaker Daimler are reporting results this morning.

We’ll be tracking all the main events through the day….

Updated