Carla Mozee

(@MWMozee)FTSE 100 turns lower year-to-date, the move coming a day after its worst session since Brexit vote. pic.twitter.com/ZXte9VnkuP

Pound hovers around $1.284

The pound is holding steady this morning – which is another way of saying that it’s not done much yet.

Sterling is trading at $1.284 against the US dollar, having surged to a six-month high of $1.29 late last night.

Bloomberg Brexit

(@Brexit)Pound stays above $1.28 after surging 2.2% when Theresa May called for a general election https://t.co/9MLpcOUhzZ pic.twitter.com/eupNnp6FFq

FXTM chief market strategist Hussein Sayed says the currency markets are closely focused on the pound.

Yesterday’s surprise move by U.K. Prime Minister Theresa May calling a snap election sent the British pound to its highest levels against the US dollar since October.

The 400-pip move [from $1.25 to $1.29] from low to high is not a reflection of the short-term fundamental outlook for the U.K.’s economy. But traders expect the snap election to lead to stronger negotiation powers with the EU on Brexit terms, thus a softer exit. Today we expect May to win parliamentary support for the snap election, but the reaction on the Pound to be mild, given it’s already priced in.

Robin Bew of the Economist Intelligence Unit reckons that low turnout might scupper Theresa May’s hopes for a whopping majority:

Robin Bew

(@RobinBew)#UK Gov will gain seats in election, but fewer than polls suggest. Partly due to exactly which seats competitive. Partly due to low turnout

While advertising magnate Sir Martin Sorrell fears the election might have a dampening effect on the economy:

Dominic O’Connell

(@dominicoc).@WPP‘s Sir Martin Sorrell says business will use snap election as “another excuse to do nothing” @BBCr4today

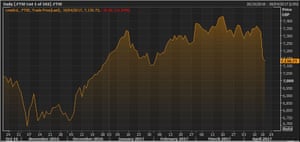

FTSE 100 sheds all its gains this year

Britain’s leading stock index has shed all its gains for 2017, as Theresa May’s election call continues to grip the City.

The FTSE 100 has fallen by 17 points at the start of trading, adding to the 180 points it lost yesterday.

That takes the blue-chip index down to 7130 points, below the closing price of 7142 on 30 December 2016. That’s also the lowest level since late January.

The FTSE 100 over the last six months Photograph: Thomson Reuters

Yesterday’s selloff was mainly due to a surge in the pound, as traders welcomed the snap election. A stronger pound erodes the value of overseas earnings, hitting the value of multinationals.

Tony Cross of TopTradr predicts that political uncertainty will weigh on the markets until the UK election is out of the way.

The market’s clear belief is that the incumbent party will win again, and with a bigger majority. This in turn will make for a cleaner break when the Brexit negotiations conclude – something that has driven the pound crosses out to six month highs.

Success in today’s vote in Parliament – which is required to approve the early election – is a foregone conclusion, but the risk is that the vote in early June doesn’t return the result that’s expected. Early polling suggests it will, but with the centrist Liberal Democrat party likely to make sweeping gains from their diminished current position, they could be the deal-makers again as they were in 2010. Given they are expected to be running on a ticket that promotes retaining single market access, we should be bracing for further volatility as this campaign unfolds over the next seven weeks.

Updated

The agenda: Election fever and IMF meeeting

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

City traders have come down with a double-dose of election fever.

The symptoms? Worrying about whether Marine Le Pen could sweep into the Élysée Palace, while also pondering how Theresa May’s snap general election call will effect the Brexit negotiations.

Campaign posters of the 11 candidates who run in the 2017 French presidential election. Photograph: Jean-Paul Pelissier/Reuters

The French presidential election is looking increasingly right, with just four days until the first round of voting.

The consensus view, that centrist Emmanuel Macron would beat Le Pen in the second round in early May, is looking shaky. With right-winger Francois Fillon and Communist-backed Jean-Luc Melenchon both gaining ground, it’s hard to say exactly who’ll claim the prized top two places on Sunday.

The prospect of Le Pen and Melenchon contesting the run-off is causing some jitters in the City.

As correspondent Angelique Chrisafis reports from Paris, tension is mounting among Macron’s team too:

The independent centrist, who is running in his first election, had been seen as a frontrunner but faces a gruelling final few days before the first-round presidential vote this Sunday.

Styling himself as a pro-Europe progressive, he went from dark-horse outsider to favourite three months ago. But as polls narrow and a third of the electorate remains undecided, the race has become increasingly uncertain.

Macron’s supporters concede that the last few days of campaigning will be tough and unpredictable. Although polls have shown he could win a second round runoff on 7 May, Macron first has to make it to the final round – and that is not by any means guaranteed.

“The new president,” said one butcher as he posed for a selfie with Macron at the market. “He hasn’t won yet!” came the cry from the scrum of media recording the moment.

“You have to vote first,” Macron reminded him gently.

Meanwhile in London, MPs are expected to approve Theresa May’s plan for a general election on 8 June.

That shock decision sent the pound to a six month high last night, but also wiped £46bn off the FTSE 100.

The City’s snap reaction is that Theresa May will claim a large majority, strengthening her hand in the Brexit talks, and removing the chance of being derailed by either pro-Remain MPs or hard-line eurosceptics.

That could cut the chances of her final deal being rejected by parliament. But it doesn’t necessarily mean Britain gets a better deal.

As our financial editor Nils Pratley says, the Brexit talks will still be tough:

If delivering a “successful” Brexit involves making a few pragmatic compromises – which is surely the lesson from the initial skirmishes with the EU negotiators – you can’t blame May for seeking cover from the hard-liners in her own party. And kicking out the next election until 2022 seems a smart political move: it would allow time for a three-year transitional phase before UK voters go back to the polls, which could take the edge off any economic shock at the moment of Brexit in 2019.

So, yes, it was fair for investors to take some comfort in the idea that a market-friendly “soft” Brexit is now easier to imagine. Just don’t get too carried away with the idea. Investment uncertainties rarely evaporate so easily. If the election delivers a messy result – even a barely improved Tory majority – what would really have changed?

Coming up today…

The International Monetary Fund is releasing its Global Financial Stability Report at 1.30pm GMT. That will identify the biggest threats to the world economy.

We get a flash estimate of eurozone inflation for April, at 10am BST.

New European car sales figures are out this morning (more on that shortly).

Fashion chain Burberry, food and closing group Associated British Foods and packaging group Bunzl are reporting results.

Updated