France’s borrowing costs have inched up this morning, widening the gap with safe-haven German debt.

That’s a signal that investors are getting more worried about Sunday’s election.

Reuters has the details:

France’s 10-year bond yield rose 2.5 basis points in early Tuesday trade to 0.93 percent, while German Bund yields were marginally lower at 0.18 percent and within sight of Friday’s more than three-month low of 0.16 percent.

That left the gap between the two at 75 basis points and not far from six-week highs hit last week around 78 bps.

The spread between short-dated French and German bond yields was at 44 bps – also within sight of six-week highs.

Christine Lagarde has also claimed that Britain’s economy is starting to suffer from last year’s Brexit vote — even though growth has been rather stronger than the IMF predicted.

QUESTION – You say the UK is still having growth, being still in the EU. Do you think that Brexit can be a bad trip for the UK?

MS. LAGARDE – As you know, we had anticipated a much lower growth than the UK has demonstrated during the last quarters. But we are beginning to see – in terms of disposable incomes, of depreciation of the currency, etc. – the beginning of the impact of Brexit. And the more discussion there is of companies or financial institutions relocating to Frankfurt, Dublin or Paris, the more uncertainty there will be in a country where the capital city plays such a role as a financial center.

The IMF will release its latest forecasts for the UK in under five hours time, as part of the World Economic Outlook. It has already revised up its 2017 growth forecast once this year, in January – from 1.1% to 1.5%……

Lagarde: Trump should tone down his ‘bad guy’ language

On America, Lagarde seems to acknowledge that criticism of Germany’s trade surplus are valid — although she doesn’t approve of Donald Trump’s approach:

QUESTION – Is Trump right to criticize the German trade surplus? Are the bad guys saying the right things?

MS. LAGARDE – I would stay away of the “bad guy” language–that is a moral judgement that does not have a place in the kind of work we do.

When there are excessive imbalances, when there is excessive inequality, or instability in the financial system, all those three are bad for stability, for the sustainability of growth. We do not shy away from saying that.

Lagarde: Greece needs debt restructuring

During her interview with European reporters, Christine Lagarde also warned that the IMF is adamant that Greece needs debt relief – and it won’t join its bailout programme until this is tackled.

QUESTION – Without a debt restructure upfront, the IMF will not participate?

MS. LAGARDE – If the Greek debt is not sustainable in accordance with the IMF’s rules and on the basis of reasonable parameters, we will not participate in the program.

QUESTION – Is the staff of the IMF now convinced that the debt is not sustainable as it is?

MS. LAGARDE – Based on the debt sustainability analysis, we will determine how much debt needs to be restructured. But there is no question in our mind that a degree of debt restructuring is needed.

Updated

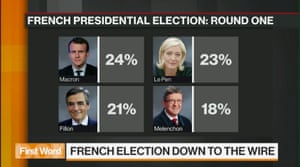

Here’s a summary of the latest French polling data:

Photograph: Bloomberg TV

Lagarde: French election weighs on ‘confidence and stability’ of euro area

Christine Lagarde, the head of the International Monetary Fund, has warned that the French presidential election is casting a “huge question mark” over the eurozone.

In an interview with several European journalists, just published, Lagarde says that France’s election race is causing rising uncertainty worldwide, and creating fresh uncertainty over the future of the currency bloc.

Here’s the key section:

Q: Is the fate of the euro also at stake in the French presidential elections?

MS. LAGARDE – It is clearly one of the debates. And one that actually weighs on the confidence and the stability of the euro area–because if one of the largest partners is wondering if its destiny and fate is in or out of the group, it is a huge question mark for the others.

Two of the candidates in this spring’s election have made no secret of their opposition to European institutions.

Marine Le Pen, the head of the National Front, has repeatedly blamed the single currency for hurting France’s economy – arguing that the country would prosper if it returned to the franc. Poll suggest that she could win the first round of voting, this Sunday.

Jean-Luc Mélenchon, the far-left candidate who is making a late surge in the polls, is also a critic of the European Union. He has vowed to renegotiate France’s relationship with the EU – and hold a referendum on exiting the Union if he fails.

Many political analysts argue that Le Pen would lose the second-round run-off to either Emmanuel Macron or Francois Fillon — both of whom are less critical of the euro.

But, as Christine Lagarde puts it, there is clearly “rising concern” about the uncertain outcome of the elections.

She says:

There is no single country that I have visited in the last couple of months where I have not been asked with anxiety what the outcome might be.

It matters because of the role played by France, the size of the French economy relative to other euro area partners, and because some of the ideas being discussed seem aimed at disrupting the current architecture of the European Union as far as France is concerned.

The sooner that uncertainty is removed, and I guess it will have to wait until May 7th, the better it will be for the global economy, and of course, for the euro area economy.

I’ll truffle through the interviews for more significant points now…

Updated

The agenda: Geopolitical tensions loom over the markets

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

City traders have lots to ponder as they return to their desks following the Easter holidays break, with plenty of geopolitical risks swirling.

The French presidential election, last weekend’s controversial Turkish referendum, and rising tensions between America and North Korea could all move the markets this week.

With less than a week to go until the first round of voting, France’s election looks pretty tight. Far-left politician Jean-Luc Mélenchon is making a late charge, gaining ground on centrist Emmanuel Macron, right-winger Francois Fillon and National Front leader Marine Le Pen.

Interestingly, Fillon appears to be shaking off the allegations of wrongful payments to family members that rattled his campaign. Kit Juckes of French bank Société Générale explains:

The latest poll (from Opinionway) puts macron and Le pen at 22%, Fillon at 21% and Melenchon at 18%. So where last week it was Melenchon who was surging, now M Fillon is closing in.

Uncertainty reigns supreme and relative rates are going to struggle to drive the Euro higher against that backdrop.

All the main candidates are making a late push before Sunday’s polls; the top two will enter the crucial second-round runoff in early May.

Francois Fillon gesturing after delivering a speech yesterday. Photograph: Valery Hache/AFP/Getty Images

Further afield, Pyongyang’s latest (failed) missile test is a particular concern to investors – especially as a senior North Korean official has warned that “thermonuclear war may break out at any moment”.

Naeem Aslam of Think Markets reckons investors are looking for Washington’s reaction (vice-president Mike Pence is in South Korea today).

North Korea faced another failure in its nuclear test and investors are wondering what will be the reaction from the US and its allies. The demand for other safe haven assets also picked up in the light of this, spot gold is moving further closer to our target of $1300.

We are sitting near a five month high. When it comes to the gold price, we do think that the momentum could easily continue and bias remain skewed for more upside move.

Chris Weston, chief market strategist at IG in Melbourne, says:

“It seems the focus is now firmly on future missile tests from North Korea and whether any future tests will actually be successful. One suspects the concerns in North Korea have further to play out.”

The Turkish lira, meanwhile, has rallied after Turkish president Recep Tayyip Erdoğan claimed a narrow, and contested, victory in a referendum to reshape Turkey’s constitution as a presidential republic.

The lira gained 2% against the US dollar yesterday as investors calculate that Erdoğan’s win means less political instability. It will certainly give him sweeping new powers; critics fear more authoritarianism and further crackdowns against the president’s opponents.

The legitimacy of the result is being questioned – as more than 1 million votes without official stamps were included. That hasn’t stopped Donald Trump giving Erdoğan a congratulations call, though…..

IG predicts that the London stock market will dip in early trading, but other European markets are expected to rise.

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7313 -0.20%

$DAX 12134 +0.21%

$CAC 5086 +0.29%$IBEX 10363 +0.36%$MIB 19818 +0.23%

On the agenda today….

The International Monetary Fund will release its latest assessment of the global economy today, at 2pm BST (or 9am Washington time).

This is the IMF’s chance to upgrade, or downgrade, its growth forecasts – and also point to problems in the world economy. Last week, IMF chief Christine Lagarde hinted that global growth forecasts could be revised up, despite its concerns over the protectionist trade policies advocated by Donald Trump.

We’ll be tracking all the main events through the day….

Updated