UK government sells £11.8bn of Bradford & Bingley loans

Britain’s government has taken another step towards extricating itself from the financial sector, nearly 10 years after the credit crunch struck.

The Treasury has sealed a deal to sell £11.8bn worth of loans made by Bradford & Bingley, the building society which was nationalised in the wild days of autumn 2008.

The mortgages will be sold to Prudential plc and to funds managed by Blackstone. The proceeds of the sale will allow Bradford & Bingley to repay some of the £15.65bn cost of its rescue.

Chancellor Philip Hammond says the deal is “value for money” to the taxpayer, adding:

“The sale of these Bradford & Bingley assets for £11.8 billion marks another major milestone in our plan to get taxpayers’ money back following the financial crisis.

“We are determined to return the financial assets we own to the private sector and today’s sale is further proof of the confidence investors have in the UK economy.”

But the task isn’t complete yet. Before today, the government held around £16bn of loans made by Bradford & Bingley, and further loan sales are expected before the end of 2018.

Updated

UK house prices fall for first time since summer 2015

Photograph: Yui Mok/PA

Is Britain’s housing market catching a spring cold?

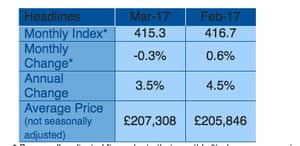

Prices fell by 0.3% in March, according to the latest data from Nationwide, the first monthly fall since June 2015.

On an annual basis (a better measure), growth slowed to just 3.5% – the weakest level since August 2015.

Photograph: Nationwide

With home ownership now at its lowest rate since 1985, this might bring some relief to those trying desperately to grab onto the bottom rung of the housing ladder.

Robert Gardner, Nationwide’s Chief Economist, says there is a “mixed picture” across the UK.

Six regions saw the pace of house price growth accelerate, six saw a deceleration and one (East Midlands) recorded the same rate as the previous quarter. Interestingly, the spread in the annual rate of change between the weakest and strongest performing regions was at its narrowest since 1978 at 6.8 percentage points – the second smallest gap on record.

“The South of England continued to see slightly stronger price growth than the North of England, but there was a further narrowing in the differential. Northern Ireland saw a slight pickup in annual house price growth, while conditions remained relatively subdued in Scotland and Wales.

Alberto Gallo, head of macro strategies at Algebris Investments, shows how the market has slowed since last summer:

Alberto Gallo

(@macrocredit)UK property pop pic.twitter.com/tVdGs6FLly

Updated

The agenda: UK GDP and eurozone CPI

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Two fairly interesting pieces of economic data are coming up this morning.

At 9.30am, the third and final estimate of UK growth in the final quarter of 2016 is published.

The top line, that Britain grew by a robust 0.7%, probably won’t change. But we’ll also learn how much of a current account deficit was racked up with the rest of the world.

Economists are predicting that this deficit shrank, to perhaps £16bn from £25bn in July-September.

RBC Capital Markets say:

The National Accounts will bring news of the current account deficit for Q4 2016 where the smallest trade deficit since Q2 2011 should be a contributing factor to a narrowing in the overall current account deficit from the 5.2% recorded in Q3.

New service sector data for January will also give an early hint on how the UK economy began 2017.

Then at 10am, the flash estimate for eurozone inflation this month hits the wires. In February, the cost of living jumped by 2% – unleashing calls for the European Central Bank to stop its money-printing stimulus programme.

Those voices may fall quiet today; eurozone inflation is expected to have dropped this month, perhaps to 1.8%, partly thanks to Easter falling later this year.

A low inflation reading could trigger some euro-selling, as it would suggest the ECB would maintain ultraloose monetary policy for longer.

Michael Hewson of CMC Markets explains:

Last month we saw CPI hit the ECB’s 2% target for the first time in four years, however this is expected to slip back to 1.8%, while core prices could also slip back from their current 0.9% to 0.8%. Anything weaker than this is likely to pressure the euro further in the short term.

So it could be a lively morning….

Also coming up today

Building society Nationwide is warning that the UK housing market is slowing, as it publishes its latest house price figures. More on that shortly.

Uk telecoms regulator Ofcom is outlining plans to cut broadband prices, by making it easier for rival operators to access BT’s superfast network.

South Africa’s markets may be lively, after prime minister Jacob Zuma fired his finance minister, Pravin Gordhan. The rand has already taken it badly, falling 2% in early trading.

fastFT

(@fastFT)South Africa’s rand falls 2% after Zuma dismisses finance minister https://t.co/A2blJymUNF pic.twitter.com/5VTSUHSbod

Updated