Sports Direct has reiterated its bold pledge to become the “Selfridges of Sport” retailing.

As it prepares for a potentially bruising AGM meeting today, SPD told the City that:

The Company is pleased to confirm ahead of today’s AGM that trading in our new generation flagship stores continues to exceed our expectations as Sports Direct moves towards the ‘Selfridges’ of sport.

I suspect that won’t stop some investors voting against chairman Keith Hellawell’s reappointment, though. Several influential shareholders, including Hermes and Fidelity, argue that fresh blood is needed at the top following recent revelations over the company’s working practices.

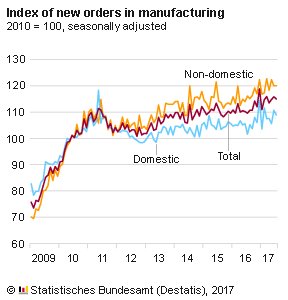

German consumer goods makers had the toughest July, suffering a 3% drop in new orders.

Capital goods (heavy duty machinery) dropped by 0.7%, while intermediate goods orders fell by 0.4%.

This is the first drop in German factory orders in three months, as this chart shows:

Holger Zschaepitz

(@Schuldensuehner)Oops! Germany factory orders unexp fall for 1st time since Apr. Manufacturing orders slipped 0.7% MoM, when mkt had exp them to grow by 0.2% pic.twitter.com/VMlBuDqmjm

German factory orders fall unexpectedly

Just in: Germany’s factories suffered a surprise drop in new orders in July, suggesting Europe’s powerhouse economy could be running out of steam.

New government figures show that factory orders dropped by 0.7% during the month, missing City forecasts of a 0.3% rise.

Photograph: Bloomberg TV

Orders from other eurozone countries fell by 1% during the month. However, orders from other nations rose by 0.6% — suggesting the recent strength of the euro isn’t hurting Germany.

But….domestic orders declined by 1.6% – perhaps a sign that German companies are taking a breather after a strong few months?

Germany factory orders can be volatile, but this isn’t exactly what chancellor Angela Merkel would hope to see ahead of this autumn’s election.

Destatis news

(@destatis_news)#Manufacturing in July 2017: New orders –0.7% seasonally adjusted on the previous month https://t.co/Wfg3FvoPK5 pic.twitter.com/7TcsyOXOU9

But the economics ministry insists that German manufacturing remains robust, saying:

Order activity remains on a very high level….

Updated

The agenda: Geopolitics worries weigh on markets

A currency trader walks by the screens showing the Korea Composite Stock Price Index (KOSPI) at the foreign exchange dealing room in Seoul, South Korea, today. Photograph: Lee Jin-man/AP

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Investors are jittery again this morning as the North Korea nuclear crisis weighs on the markets.

Asian stocks are dropping today, following a nervy session on Wall Street last night that saw the Dow Jones fall 1%.

The selloff comes as South Korea’s president, Moon Jae-in, warned that the crisis on the Korean peninsula risks becoming “uncontrollable”.

Speaking at a bilateral meeting with Russian president Vladimir Putin, Moon declared:

“The global political situation has become very serious due to North Korea’s repeated provocations.”

South Korean media are reporting that Moon asked Putin to help “tame” North Korea, following last Sunday’s nuclear test.

More details here:

On the economics front, we find out how whether America’s trade gap with the rest of the world widened or narrowed, and how its service sector performed in August.

We’ll also be watching two annual general meetings, with retailer Sports Direct and housebuilder Berkeley Group facing their shareholders.

Sports Direct’s chairman, Keith Hellawell, will face a rebellion from investors who believe he should resign.

And there’s a possibility that Canadian interest rates could rise today, as the Bank of Canada holds its latest monetary policy meeting.

Here’s the agenda:

- 1.30pm: US trade balance for July

- 3pm: Bank of Canada interest rate decision

- 3pm: US service sector PMI for August

Updated