North Korea’s latest missile test is overshadowing China’s latest gathering of leading emerging economies such as Brazil, Russia and India.

That will surely irritate China’s president, Xi Jinping, as the Brics summit is a key platform for Beijing’s international ambitions. Yesterday, Xi warned that “incessant conflicts in some parts of the world” were threatening global piece.

Fiona Cincotta of City Index says the timing underlines Kim Jong Un’s ‘extraordinary’ defiance, and could provoke a response from China.

Whilst he knows the US will no doubt implement further economic sanctions, this time he risks the wrath of China, the only county that could potentially strangle North Korea’s economy.

North Korea carried out the nuclear test on Sunday with full knowledge that it would enrage Beijing, with the timing threatening to overshadow the BRIC summit hosted by Chinese President Xi. Yet the rogue state paid little regard to this, which is concerning as it means there appears to be little preventing Kim Jong escalating the tension further.

Here’s more details on the Brics summit:

My colleagues around the world are live-blogging the latest developments in North Korea here.

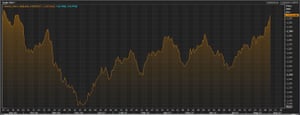

Gold jumps to 10-month high

The gold price has hit its highest level in almost a year, as North Korea’s latest weapons test drives investors into ‘safe haven’ assets.

Bullion is changing hands at $1,337 per ounce, its highest level since last November – when Donald Trump’s shock election win rattled the markets.

The gold price over the last year Photograph: Thomson Reuters

Mike van Dulken of Accendo Markets says gold is the “major beneficiary” from rising tensions in the Korean peninsula.

Expect North Korean rhetoric to heavily influence the safe haven asset throughout the day as global leaders react to the latest provocations.

The agenda: North Korea tensions hit shares

Japan’s stock market fell by almost 1% today as the yen strengthened Photograph: Toshifumi Kitamura/AFP/Getty Images

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

It’s back to school in the UK after the summer break. But City workers are back to fretting about North Korea after it tested what it claimed was a powerful nuclear bomb on Sunday.

Pyongyang’s latest provocation comes just a few days after it fired a missile over Japan.

So with the US threatening a ‘massive military response’, and South Korea simulating its own reaction, there’s plenty to worry investors this morning.

As Craig Erlam, senior market analyst at OANDA, puts it:

Financial markets are back in risk aversion mode on Monday after the latest nuclear test from North Korea on Sunday triggered the usual safe haven rush.

Asian markets have already been hit; Japan’s Nikkei dropped by almost 1% as nervous traders drove up the value of the yen.

European stock markets are also expected to follow suit too, with falls of around 0.5% expected.

Rob Carnell, ING’s head of Asian research, says:

“Like a bad horror movie, the North Korea saga intersperses moments of calm, with occasional action to jolt you out of your chair.”

However, Carnell reckons it could be a good buying opportunity for investors – unless the situation really does deteriorate (via Reuters).

US traders won’t be able to react today, though, as New York is closed for the Labor Day holidays.

IGSquawk

(@IGSquawk)Our European opening calls:$FTSE 7428 -0.14%

$DAX 12078 -0.53%

$CAC 5100 -0.46%$IBEX 10281 -0.43%$MIB 21753 -0.48%

Investors are also awaiting a new healthcheck on Britain’s building sector. Markit’s construction PMI is expected to remain close to July’s 11-month low of 51.9 in August.

We’ll also be watching McDonalds, where workers at two stores are protesting about the fast food chain’s low pay and zero-hours contracts.

Here’s the agenda:

- 9:30am BST: Eurozone Sentix investor Confidence for September

- 9.30am BST: UK construction PMI report for August

- 10am BST: Eurozone producer prices index for July

Updated